2008 Massachusetts Ballot Initiative

("Question 1") to End the Income Tax

Current campaigns and projects

Frequently Asked Questions

* Will Question 1 affect property taxes?

*

How can we cut $12.6 billion in waste?

* How

do the retirement Govt. and private companies compare?

*

What are some of the other Mass taxes?

* What

is Question 1?

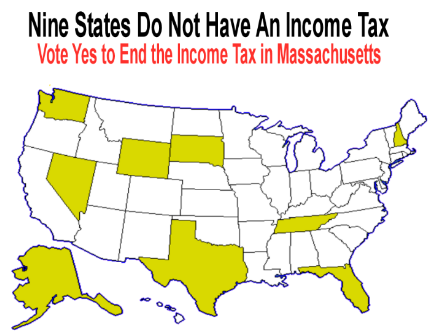

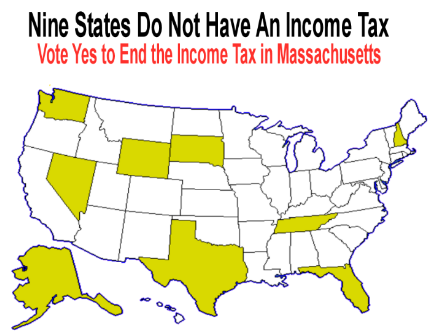

* Which states do not have an

income tax?

* How much $ will go back into my

budget?

* Does Q1 go far enough?

*

Who’s behind the No vote?

* Can we see the

state government budget?

* Shouldn't we try

transparency first?

* What is the real

budget?

Will Question 1 affect property

taxes?

Question:

Groups that oppose Question 1 say that ending the income

tax will raise property taxes. Is that true?

Answer:

No. Question 1

forces the legislature to cut state spending, not city or town government

spending.

If anything, we should cut other taxes as well as ending the

income tax -- to get rid of all government waste.

The state government hands

out $5 billion in subsidies to city and town governments in Massachusetts every

year.

As of fiscal year 2009, you and 3,400,000 other taxpayers pay $12.6

billion in income taxes to the state government every year.

In other

words, for every dollar you pay, your town gets back 40 cents. Does that sound

like a bargain to you?

Let's assume Question 1 wins, we end the income

tax, and the very worst "doom and gloom" scenario our opponents like to paint

came to pass: the legislature cuts 100% of state aid to city and town

governments. You would no longer pay $1.00 to get just 40 cents in return. You'd

be 60 cents ahead of where you are now.

But that’s not all.

That

40 cents the state hands out to city and town governments doesn’t go to you. It

goes to the politicians in your town – and their special interest pals.

That 40 cents pays for things like extravagant and unnecessary building

contractors and architects like the ones charging taxpayers $200 million to

build a high school in Newton, Massachusetts. They paid $35 million of that to a

fancy architectural firm for the school's design – enough to build an entire

high school!

That 40 cent on your dollar pays for lucrative government

employee pensions and generous government employee health care benefits – far

better than what you get from your employer.

If you're an average

taxpayer, how much of that 40 cents benefits your family? For every dollar you

pay in income tax, you may get back 25 cents or 10 cents or 5 cents in benefits.

But it gets worse.

That 40 cents of every dollar you pay in income tax

that the state hands out to city and town governments is not evenly distributed.

Many town governments see only a fraction of that 40 cents. The bulk of it goes

to big city governments – home to the state’s worst corruption, crime and

dysfunctional public schools. A lot of that 40 cents pays for the worst schools

in the state – at a rate that’s often TWICE as expensive as what small and

medium size towns pay per pupil for better schools!

Who profits most from

state aid to city and town governments?

The same people who oppose

Question 1, who oppose this $3,700 tax cut for you and your family. Government

employee unions. Builders who get government contracts.

You can vote No

on 1, continue to pay an average of $3,700 every year in income taxes and get

back perhaps $185 to $985 in benefits. A net loss of $3,515 to $2,715 every

year.

Or you can vote YES, get back $3,700 on average you're now paying

in income taxes, and get back perhaps $0 to $985 in benefits. A net gain of

$3,700 to $4,685 every year.

Which is better for you, your family, and

your neighbors?

How can we cut $12.6 billion

in waste?

Question:

Where will we find $12.6 billion in waste to cut from

this budget?

Answer:

Our current budget minus the income tax equals

the 1999 state budget.

Here are a few examples of waste we can get rid

of:

· $7 billion in refinancing cost for the Big Dig.

· $2.55 billion

MORE added this year to the lucrative pensions for retired stategovernment

employees - who get 2-3 times the retirement income you'll get if you're an

average taxpayer. Government employees retire in their 40's 50's and early 60's

- while you have to work until your late 60s.

· $1 billion in tax

subsidies to multi-billion dollar bio-tech pharmaceutical corporations.

·

$2 billion in interest payments every year for unnecessary debt spending to fund

road projects. Pay for roads with gasoline tax and auto registration fees, and

there is no need to rack up debt. Liquidate some of the state's many financial

slush funds to pay down debt and reduce interest payments.

· $138.7

million tax subsidy to millionaire movie stars and directors.

· Several

billion dollars/year in excess government employee health care benefits. Bring

their copays, deductibles and coverage in line with the average taxpayer.

· $60,000 to $70,000 a year paid to toll collectors - plus benefits, plus

pensions. This is for UNSKILLED jobs – counting and making change. A job that

can be done by public schools 5th graders, high school dropouts, people trying

to get off welfare, or even mentally challenged individuals who want to be

contributing members of society.

· Several hundred million dollars every year

spent on unnecessary and overpriced public school construction. Example: $200

million high school in Newton, Massachusetts. A large fraction funded out of the

state government budget.

· Over $6 billion we could cut from the budget

and give back to taxpayers by renegotiating the terms and money of government

pensions for state government employees, city and town government employees, and

public school teachers.

But that’s just the tip of the garbage heap. If

the Massachusetts legislature will "Show Us the Tax Money" - open the

Massachusetts state government books - as we requested in our 2/8/08 open letter

to the state legislature, 3,400,000 taxpayers can be watchdogs to identify and

remove the worst excesses and government waste.

We propose that the

legislature publish the complete $47.3 billion Massachusetts budget – including

all off-budget spending items - on a web site that is easily readable and easily

searchable. Detail every check written by the state, to whom it is written and

what it’s for. Just as they force you to do when you file a tax return.

Once we have a detailed budget, we cut government waste by prioritizing. Fund

the essential services that people want and need the most. Clean the waste out

of each department so taxpayers get the best price possible. Once essential

services are funded, cut spending from the rest of the budget.

This will

leave us with a lean, effective and efficient state government that serves the

workers and taxpayers, not special interests. It will cost taxpayers a fraction

of today’s Massachusetts government.

Because we will uncover much more

waste than the $12 billion that the income tax funds, we can then cut the

property tax and other taxes - in addition to ending the income tax.

How do the retirement Govt. and private companies compare?

Why haven't you been told these things about Massachusetts government employee

retirement packages?

Compare what government employees get with what the rest of us get:

Government Employee

Retirement Package |

Private Sector

Retirement Packages |

|

Retire at age 54 |

Retire at age 67 |

30 years on the job for full retirement pay

6,600 work days |

43 years on the job for full retirement pay

10,320 work days |

$42,000-$68,000 retirement pay starting at age 54

|

$16,000-$22,000 retirement pay from Social Security starting at age 67 |

|

Cadillac-quality health care insurance |

Medicare or Medicaid |

|

Pay 2%-9% contribution to government employee retirement

plan. Exempt from Social Security tax |

Pay 6-13% Social Security tax |

|

Double-dipping retirement allowed - collect salary for

working AND get retirement pay |

Lose Social Security pay if you work |

Almost fully funded

$50.6+ billion in the bank - at taxpayer expense |

Zero dollars in the bank

IOU slips from the federal government

As sound as

AIG |

Guaranteed payout amount

Shielded from stock market swings |

No guarantee of any payout

No government obligation to pay Social Security |

$6 billion back to taxpayers. We can cut $6 billion a year in

government spending and taxes by renegotiating these plush, outrageously

over-priced government employee retirement packages. Including public school

teachers.

Is it any wonder that government employee unions are financing 99.8% of

the opposition to Question 1, a tax cut for you and your family?

Is it right for you to work hard all your life to fund such lucrative

government employee retirement pay - and leave you and your family with scraps?

Vote YES on 1 - and force polticians to bring budget-busting

retirement packages in line with what you'll get. It's the fair thing to do -

for you, your family, your neighbors, your co-workers, and 3,400,000 workers and

taxpayers of Massachusetts.

What are some of

the other Mass taxes?

Massachusetts government will be swimming in cash from

plenty of other taxes still on the books after we End the Income Tax.

The

Massachusetts' total tax burden will still be higher than New Hampshire's

because the city, town and state governments of Massachusetts will still have

$57 billion to spend AFTER we end the income tax.

Where do they get all

that money?

Here’s some of the taxes that you, your family members, your

neighbors and your co-workers will still have to pay after we END the income

tax:

* Sales tax

* Business and corporate taxes

* Death

(estate) tax

* Motor vehicle registration and license fees

*

Turnpike, bridge and tunnel tolls (that politicians promised they’d take down)

* Gasoline tax

* Alcohol tax

* Cigarette tax

*

Professional license fees

* Water tax

* Sewer tax

*

Mortgage taxes

* House closing fees and taxes

* School fees (bus,

sports etc.)

* Fishing, hunting, and gun license fees

* Cable TV

tax

* Long distance phone tax

* Electricity tax

* Ferry

ride fees

* Boat anchor fees

* Court fees

* State room

occupancy tax

* Excess lottery profits

* Fines

* Requests

for Public Records (which should be free! We shouldn't have to beg politicians -

and pay a fee - to find out how our money is being spent!)

And this

doesn’t even include your local taxes such as:

* Property tax

* Community Preservation Act tax

* Auto excise tax

* Local room

tax

* Rental car tax

* Taxi medallions

* Building permit

fees

* Liquor license fees

* Hotel tax

* User fees (e.g.,

dump stickers; marriage, birth, and death certificates; Title V filing fees, and

hundreds more)

The state governments will also continue to rake in

revenues from other taxpayer-funded sources including:

* Investment

earnings. The state holds tens of billions of dollars in financial assets from

which they make billions of dollars in returns every year. If politicians were

not overtaxing you all these years and stuffing tax surpluses into these

government bank accounts, that wealth would be in YOUR bank account making a

return for YOU instead.

* Bond proceeds

* Lawsuit settlements,

e.g., from cigarette and food manufacturers (a tax on food and cigarette

buyers).

* Federal grants and subsidies - paid for by your federal taxes.

Massachusetts is a “net payer” state, meaning we pay more in federal taxes than

the state gets back in subsidies.

All these tax and revenue sources is

why the city, town and state governments of Massachusetts will still have $57

billion to spend AFTER we end the income tax. More than $16,700 per taxpayer -

every year!

Ending the income tax is a first, critical step towards making

Massachusetts an affordable place for your family to live.

Vote YES on 1

!

What is Question 1?

Question 1: The

Small Government Act to End the Income Tax

The Small Government Act to

End the Income Tax is a Massachusetts citizen initiative - Question 1 on the

November 4, 2008 general election ballot.

If a simple majority of voters

say "YES" to Question 1 on November 4th, the Small Government Act to End the

Income Tax will become law. We will end the Massachusetts state income tax.

The new law will go into effect immediately when election results are official,

and will affect taxpayers starting January 1, 2009.

The Small Government

Act to End the Income Tax is a binding referendum, not a constitutional

amendment nor an advisory question. It's a statute, just like any law passed by

the legislature. If a majority of voters say "Yes", it will be encoded in the

Massachusetts General Law, the body of law for the state government, the

Commonwealth of Massachusetts.

If we END the Income Tax in Massachusetts:

- You will save an average of $3,700 for each taxpayer in your family. Money

you'll be able to spend on your family, save for your retirement, or give away

to your favorite charity - in your own community.

- You will no longer

pay the 5.3% income tax on wages.

- If you're living on an annuity, you

will no longer pay the 5.3% income tax on interest or dividends than you need to

make ends meet.

- If you sell your house or your business, or need to

liquidate your stock or retirement fund, you will no longer pay 5.3-12% interest

on capital gains.

Best of all, we'll take $12.6 billion now wasted and

misspent every year by politicians on Beacon Hill and put it back into the hands

of the men and women who earned it.

Summary (as appears on petition

sheets and in the 2008 Official Massachusetts Information for Voters guide as

Question 1):

This proposed law would reduce the state personal income tax

rate to 2.65% for all categories of taxable income for the tax year beginning on

or after January 1, 2009, and would eliminate the tax for all tax years

beginning on or after January 1, 2010.

The personal income tax applies to

income received or gain realized by individuals and married couples, by estates

of deceased persons, by certain trustees and other fiduciaries, by persons who

are partners in and receive income from partnerships, by corporate trusts, and

by persons who receive income as shareholders of “S corporations” as defined

under federal tax law. The proposed law would not affect the tax due on income

or gain realized in a tax year beginning before January 1, 2009.

The

proposed law states that if any of its parts were declared invalid, the other

parts would stay in effect.

Full text of The Small Government Act to End

the Income Tax

State Personal Income Tax

OFFICIAL STATEMENT IN

FAVOR – 150 words

“41% waste in Massachusetts state government,” reveals

survey. Eliminating government waste is one reason to vote “Yes.”

Your

“Yes” vote cuts your state income taxes 50% starting this January 1st – and

eliminates the last 50% next January 1st. For you and for 3,400,000

Massachusetts workers and taxpayers.

Your “Yes” vote gives back $3,700

each to 3,400,000 Massachusetts workers and taxpayers – including you – on

average when we end the state income tax. $3,700. Each worker. Every year.

Your ”Yes” vote will create hundreds of thousands of new Massachusetts jobs.

Your ”Yes” vote will NOT raise your property taxes NOR any other taxes.

Your ”Yes” vote will NOT cut, NOR require cuts, of any essential government

services.

Your “Yes” vote rolls back state government spending 27% -

$47.3 billion to $34.7 billion – more than state government spending in 1999.

3,400,000 Massachusetts workers, taxpayers and their families need your help.

Please vote “Yes.”

Authored by:

Carla Howell, Chair

The Committee

For Small Government

P.O. Box 5268

Wayland, MA 01778

www.SmallGovernmentAct.org

Full text of The Small Government Act to End the Income Tax

Which states do not have an income tax?

Alaska, Florida, New Hampshire, Nevada, South Dakota,

Tennesse, Texas,

Washington, Wyoming

Let's add Massachusetts

to the list!

Vote Yes on Question 1.

How much $

will go back into my budget?

$ Back in YOUR Budget

When the income

tax ENDS in Massachusetts:

* Families will save an average of $3,700

for each taxpayer. Money to pay the mortgage and everyday bills, pay off school

loans and credit cards, save for retirement, or give to individuals and

charities in need.

* No more 5.3% income tax on your wages.

* For

those living on an annuity, there will no longer be a 5.3% income tax on

interest or dividends.

* House, business, and stock sales will no longer

carry a 5.3-12% interest on capital gains. Sell your stock or your house when

you need - not when tax rules may force you to sell at a loss.

Best of

all, we'll take $12 billion out of the hands of Beacon Hill politicians who

waste, misspend, and hand out it out in pork-barrel projects, sweetheart deals,

and Big Government Programs. We'll put that $12.6 billion back in the hands of

the men and women who earned it who will use it much more wisely than the state

legislature. $12.6 billion pumped back into Massachusetts communities will

create jobs and save the faltering Massachusetts economy.

YES on 1 this

November 4th will cut your income taxes in half this January 1st and end the

income tax one year later. For you, your family, your friends, your co-workers

and your neighbors.

Vote YES on Question 1

CUT GOVERNMENT WASTE !

CUT TAXES !

Does Q1 go far enough?

Does

Ending the State Income Tax Go Too Far?

"41% waste in Massachusetts state

government," says Fabrizio Survey released by Citizens for Limited Taxation in

May 2008. The researchers asked likely voters how many cents on every tax dollar

they believe is wasted by the Massachusetts state government. The mean average

response was: 41 cents wasted out of every tax dollar. 41%.

As of fiscal

year 2009, the Massachusetts state government spends $47 billion every year --

on top of local government spending.

The state income tax takes $12

billion from taxpayers every year. Ending the Massachusetts Income Tax would

roll back total state government spending 27% -- to $35 billion a year, the 1999

Massachusetts state government spending level.

Reducing state government

spending by only 27% leaves the state government way more than it needs. With

41% waste, a 27% cut removes only 2/3rds of the waste in state government

spending. There will still be billions more in uncut government waste, every

year, in Massachusetts state spending - even after we end the income tax.

City and town governments collect an additional $22 billion in property taxes

and other revenue. That's in addition to the $5 billion they get in aid to city

and town governments.

After we end the income tax, and give back $3,700

on average, each to 3,400,000 workers and taxpayers, total Massachusetts city,

town and state governments will spend over $16,700 per taxpayer per year. Sound

like enough to you?

The real question is:

Does Ending the Income

Tax go far enough?

Who’s behind the No vote?

Why are the opponents of this tax cut for you and your family trying to scare

and threaten you into voting against Question 1?The

opponents of ballot Question 1 are the same groups - government employee unions,

large financial corporations and others that profit from high government

spending - who have been lobbying and campaigning to RAISE your property

taxes for 28 years. They have campaigned for more than 4,000 property tax

increases in towns across Massachusetts.

They want to

raise your property taxes AND force you to keep paying the income tax.

They're PRAYING you won't find out:

- There's TENS OF BILLIONS OF

DOLLARS IN GOVERNMENT WASTE in the Massachusetts state budget. Opponents of

question 1 profit from this government waste. Ending the income tax cleans

out part of that waste.

- A survey showed that Massachusetts voters

estimate that 41% of all state government spending is wasted. It may be much

higher. 41% is about $20 billion dollars wasted every year. Ending the

income tax removes only two thirds ($12.5 billion) of that government waste.

-

There will still be $57.3 billion in Massachusetts government spending AFTER

we end the income tax. Massachusetts city, town, and state governments will

spend over $16,700 per taxpayer per year AFTER we end the income tax. They

spend over $20,000 per taxpayer today - the 5th highest tax burden of any

state!

- City and town governments raise and spend $22 billion every

year independent of the state government. That's as much as the 20-year Big

Dig project! And that's on top of the $5 billion they get in aid from the

state government.

Government employee unions are funding 99.8% of opposition

to this income tax cut for you. Government employee unions get higher pay,

obscene pensions, and lucrative health care benefits compared with the average

worker and taxpayer.

Corporate lobby groups funded by

large financial corporations and others that do business with the state oppose

this tax cut for you. Their members profit from high taxes, high government

spending, and government regulations that shield them from competition, allowing

them to charge you higher prices.

An embarrassing .2%

of the opposition is funded by individuals. It is almost 100% funded and

supported by Special Interest groups.

In contrast, proponents of Question 1 to cut your taxes are small,

individual donors and volunteers.

Compare Yes on 1 and No on 1 supporters:

|

Yes on 1 Supporters |

No on 1 Supporters |

|

99.8%

financed by individuals and small businesses |

99.8%

funded by government employee unions. |

|

Funded

by individuals from their after-tax earnings. |

Indirectly funded by your tax dollars. |

|

Endorsed by the Wall Street Journal and Forbes Magazine |

Endorsed by unregistered business lobby groups that represent tax-funded and

supported businesses. |

|

Advocate for broad-based tax cuts that benefit millions of taxpayers |

Advocate for targeted tax cuts that benefit only their wealthy clientele. Oppose

tax cuts for everyday workers.

|

Can

we see the state government budget?

Question:

Doesn’t the

Massachusetts government already publish the state’s budget? Shouldn’t taxpayers

be able to look at it and see where the government waste is?

Answer:

The Massachusetts legislature and the governor refuse to show us, and you, the

tax money.

The “budgets” they publish leave out 40% of state spending.

You have to dig very hard to just to get a summary budget that shows the state's

total spending of approximately $47.3 billion every year.

None of the

budgets they publish, even when you dig hard, show the detail that the state

government requires of you when you file your taxes. We must see the detail in

order to identify and remove all of the waste.

Wasteful spending - like

double-dipping pensions and body builders on permanent disability leave - are

impossible to find in any state budget published for public consumption. You

only learn about them when they get leaked to the press - and the press is

willing to publicize them. Too often, they won't.

On February 8, 2008, we

asked the legislature to show us the tax money. To publish the operating budget

of each of the state’s 538 agencies and entities on a web site that is easily

read and easily searched. To show us all of the state's revenues and

expenditures – including approximately $19 billion in “off budget” spending.

By posting the full, detailed state budget online, the 3,400,000 workers and

taxpayers of Massachusetts can serve as watchdogs for government waste and

overspending.

Our request of the legislature to show us the tax money

remains unanswered.

We requested a detailed budget from the state

government using a Freedom of Information Act request. We were told they could

not produce this until January of 2009 (after the election!) and that they will

charge us over $6,000 for this information.

Taxpayers should not have to

beg for information nor pay for it. Full disclosure of government spending

should be automatic. Government transparency should be priority #1 for the

legislature and the governor. These tax consumers should be required to show you

the tax money. To detail state spending just as they require of you, the

taxpayer.

Until they do, it is reasonable to suspect they are wasting

much more than 41% of what they spend - the amount voters already believe they

are wasting.

Do you want your tax dollars paying for a government

department that refuses to fully disclose its budget online for you and other

taxpayer to see?

Shouldn't we try

transparency first?

Question:

Shouldn’t we try to force the state

government to open its books first, then pass a tax cut?

Answer:

Transparency has already been tried. The Freedom Of Information Act (FOIA) is

already on the books.

FOIA was passed to force transparency of government

finance and other government information. It requires the government to release

information upon written request from any citizen and to charge no more than a

nominal fee for the service.

But FOIA doesn’t work. The federal and state

governments have stonewalled and blocked thousands of FOIA requests.

Our

last of several requests for a detailed Massachusetts state budget using the

FOIA was met with a reply from the state indicating that they would only provide

us the information if we pay over $6,000! They said the soonest they would

provide us this information is this January 2009 - after the election!

The days of waiting for the legislature to open its books and do the right thing

have long passed. The situation is now urgent. High spending by the

Massachusetts legislature is bankrupting the taxpayers and driving workers and

businesses out of the state. We must reverse this immediately by ending the

income tax.

Vote YES on 1.

What is

the real budget?

$47.3 Billion is

the total state government budget for this year (fiscal year 2009).

Opponents of this tax cut for you - politicians and special interests who profit

from high government spending - talk about only part of the budget. They're

hiding from you $16-19 billion dollars in "off budget" government spending.

FACT: $69.3 billion is the total of

state, city and town government budgets in Massachusetts this year.

FACT: Politicians in Massachusetts are spending more than

$20,300 per taxpayer per year. Yikes! No wonder workers and taxpayers

have been leaving Massachusetts for states with no income tax.

FACT:

Massachusetts has the 5th highest tax burden in

the country. After we end the income tax, our state's overall tax burden

will still be higher than New Hampshire's.

While some mainstream news

reports accurately cite the $47.3 billion in state government spending, a number

of news articles give cover to the opponents of this tax cut for you by

reporting partial figures as the "state budget." This media distortion helps to

cover up the real spending - and helps hide and obscure the government waste in

Massachusetts government. The media's refusal to report total state spending is

a breach of taxpayer trust, and it cripples the democratic process designed to

represent the majority of Massachusetts voters.

The $47.3 billion total

state budget comes from an audited Massachusetts government report at this

government web site:

TOTAL MASSACHUSETTS BUDGET. Go to page 318 of the pdf file (page 310 of the

government report) titled "Ten-Year Schedule Of Expenditures And Other Financing

Uses By Secretariat." You'll see that Massachusetts state spending two years ago

was $44.9 billion. If you look at the nine prior years, you'll see state

spending goes up at the rate of over $1.2 billion per year, putting it at $47.3

billion this year.

As sponsors of Question 1 to End the Income Tax, we’ve

been in several debates with our opponents. They do not deny the validity of

this government report that shows $47.3 in state spending - because it is

irrefutable. It’s the state’s official, audited report on state government

spending published by the state Comptroller's office.

In their attempt to

distract you from knowing that the state is spending $47.3 billion every year,

they point out that part of that budget is lottery prize money. We agree that

the $3.5 billion the state pays in lottery prize winnings is an unwise

expenditure to cut. Legislators need to look to the remaining $43.8 billion

portion of the state budget and find the most wasteful and unnecessary $12.6

billion part of it to cut when we end the income tax.

The city and town

governments spend an additional $22 billion from your property taxes and other

revenues every year ($27 billion total spending, minus $5 billion in subsidies

from the state government). Go to this link to see their budgets:

Total Massachusetts City and Town Government Income and Spending!

Total Massachusetts state, city and town government spending this year:

$69.3 billion.

Ending the income tax cuts state spending by $12.6

billion – leaving $56.7 for politicians to spend every year. It puts $12.6

billion back into the hands of the Massachusetts workers and taxpayers who

earned that money.

That’s $16,700 per

taxpayer per year for Massachusetts government – AFTER we end the income tax.

Sound like enough for you and your family to pay for Massachusetts government?

Vote YES on 1 November 4th to END the

Income Tax.

Want to let your friends, co-workers and loved ones in on the

state's financial cover up? Print our flier "Why

Haven’t You Been Told These Things about Ballot Question 1?"